Introduction

Identity Guard® offers decent protection from identity theft. Identity Guard primarily notifies you of unusual or suspicious activity that may indicate fraud and helps protect you from identity theft. At its higher tiers, it can help you monitor your credit too.

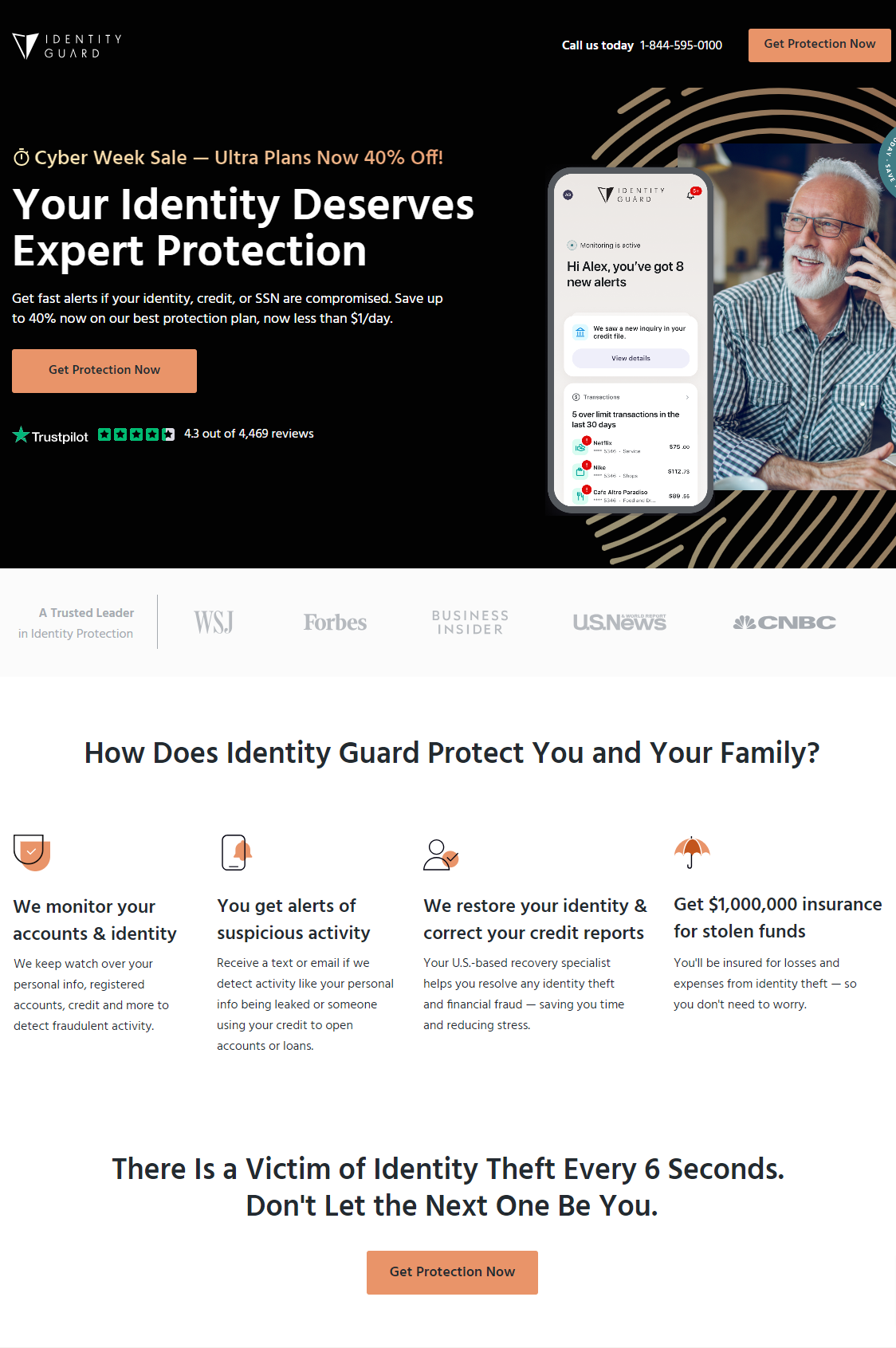

To help protect consumers against the potentially devastating consequences of identity theft, companies such as Identity Guard aim to alert their customers to unusual activity using their personal information. If you’re looking for comprehensive identity theft protection at a good price, Identity Guard may be your top choice.

There Is a Victim of Identity Theft Every 6 Seconds. Don’t Let the Next One Be You.

Features

Stolen Funds Reimbursement

If your identity gets stolen and you suffer a financial loss as the result of that theft, Identity Guard provides up to $1 million in reimbursement for those costs. This can include legal fees, lost wages, travel expenses, and child care costs related to dealing with your identity theft case and trying to restore your stolen identity.

High-Risk Transaction Alerts

Identity Guard gets to know the typical pattern of transactions that hit your credit report or other financial accounts. If they notice something that looks out-of-the-ordinary, such as a large purchase or a purchase originating in a foreign country. They then notify you of these transactions so you can respond if necessary, minimizing the risk to your finances.

Financcial Account Monitoring

Identity theft also can involve stealing your money, such as changing the contact information on your bank account or directly transferring money out. Identity Guard provides monitoring of your financial accounts for unusual activity, and they alert you in the event that they see something strange happening so you can take action.

Safe Browsing Extension

With its safe browsing extension, Identity Guard aims to help you prevent identity theft before it even starts, giving you a safer, more secure way of browsing the internet and protecting you from getting your identity stolen.

Other Information to be Considered

- Founded in 1996

- A+ rating with the Better Business Bureau

- Immediate notifications by phone, email, text, or in the app

- Wide variety of monitoring available

- Affordable monthly pricing

- Discounts for paying annually

- $1 million in identity theft insurance

- Family plans available at all pricing levels

- Uses IBM Watson Artificial Intelligence for identity theft monitoring

- Offers both identity theft monitoring and credit monitoring with higher-tier plans

Identity Guard - Pros & Cons

What we like :

- More than 20 years in business

- A+ rating with the Better Business Bureau

- Affordable monthly plans

- Discounts for paying annually

- Family identity theft monitoring available

- Uses IBM Watson Artificial Intelligence to scan for your personal information

- Safe browser extension helps you prevent identity theft before it happens

- Convenient mobile app gives you immediate alerts

- Offers both identity theft monitoring and credit monitoring

- $1 million in identity theft insurance to help cover lost wages, legal fees, and more

What we don't like :

- No actual help recovering your identity when it’s stolen

- Complete monitoring available only with higher-paid plans

- Some reviewers report receiving a high volume of emails

Frequently Asked Questions

What Is Identity Theft?

Identity theft is a crime where a thief steals your personal information, including your Social Security number, birthdate, or other personal details, with the aim to commit fraud. This fraud can include opening new credit card accounts in your name, applying for loans, and using your name to commit a crime.

Can I Enroll in Identity Guard if I Have a Security or Credit Freeze in Place?

Answer is YES, you can still enroll in Identity Guard’s services if you have a security freeze on your credit reports.

Does Identity Guard Protect Me from Identity Theft?

Identity Guard does not take any steps to protect you from identity theft. However, its secure browsing extension is designed to help you browse online safely, keeping your information safer than traditional browsers.

How Soon Does Coverage Start After I Enroll?

As soon as you complete your enrollment with Identity Guard, your coverage begins.

What is the identity theft insurance limit?

If your identity gets stolen and you suffer a financial loss as the result of that theft, Identity Guard provides up to $1 million in reimbursement for those costs.

This can include legal fees, lost wages, travel expenses, and child care costs related to dealing with your identity theft case and trying to restore your stolen identity.

Does Identity Guard Offer Other Kinds of Services?

Identity Guard only offers identity theft monitoring and credit monitoring services.

How Much Does Identity Guard plans Cost?

Depends on the level of service you choose, whether you opt for family coverage, and whether you elect to pay on a monthly or annual basis.

Individual plans range from $8.99 to $24.99 per month when billed monthly, and you receive a 17 percent discount if you choose to pay annually instead. This puts plans between $7.50 and $20.83 per month.

Family plans are priced from between $14.99 and $34.99 monthly, or between $12.50 and $29.17 per month when paid annually.

Discounts on Identity Guard Identity Theft Protection

Identity Guard offers a 17 percent discount for customers who elect to pay a year’s worth of services in full instead of being billed monthly.

How Does Identity Guard Identity Theft Protection Work?

When you sign up for Identity Guard identity theft protection, you provide the company with some of your personal information. This may include your name, physical address, and Social Security number. Identity Guard uses IBM Watson Artificial Intelligence to constantly scan various sources of data, including the dark web, for mentions of your personal information. If they detect something strange or unusual about the activity they see, they alert you to that activity.

dentity Guard doesn’t provide you with much in the way of actual identity restoration services, as they just suggest steps you can take rather than being an active part of the process. However, if you suffer financial loss as the result of identity theft, such as someone accessing your bank accounts, Identity Guard does offer up to $1 million in compensation for such a theft.

All customers can access their immediate alerts through Identity Guard’s mobile app, meaning you get notified as soon as something changes so you can take quick action.