Introduction

The LifeLock Brand is part of NortonLifeLock Inc. One of the biggest names in identity theft protection, LifeLock offers a variety of monitoring services to alert you if your information has been stolen.

LifeLock is committed to providing its consumers some peace of mind amid the threat of identity theft. For those who want a more hands-off approach to monitoring their credit and personal information profiles, LifeLock can be an effective choice.

LifeLock Identity Theft Protection: What You Need to Know

Features

Identity Monitoring

LifeLock’s identity monitoring keeps a close watch of key areas where signs of identity theft might pop up. That includes:

- USPS address changes

- Crimes registries

- Data breach notifications

- Dark web content

- Sex offender registries

- Court records

LifeLock will let you know if any changes occur, or if your personal information appears in areas where it shouldn’t, like in home address change requests, dark web forums, or data breach lists. With LifeLock on the watch, you stand a fighting chance to prevent identity theft.

Lost Wallet Protection

If you lose your wallet, having someone to back you up sounds great at first. However, this service mostly just amounts to a LifeLock representative advising you to freeze your credit cards if you lose your wallet.

Financcial Account Activity Alerts

Receive alerts whenever a purchase is made on your credit cards, or a transaction is recorded on any of your bank accounts. If you see something that doesn’t seem right, you can react and report the fraudulent transaction. With this service, you can view alerts on all your financial accounts in one place rather than multiple websites.

USPS Address Change Verification

criminals can change your official address with your bank or other financial institution, and you may not find out until it’s too late. To receive this monitoring, you need to provide LifeLock with all your banking user IDs and passwords.

Court Records Alerts

With LifeLock’s Advantage and Ultimate Plus plans, they will scan court records for your name and birthdate. If they find any court records, they report that information to you. While this service seems like a good idea, it’s very unlikely you will need it and it may not be worth the extra monthly fees just to receive it.

Reimbursement for Stolen Funds

In case you are the victim of theft as the result of stolen information, LifeLock offers from $25,000 to $1 million in reimbursement for stolen funds, depending on your chosen plan. However, this reimbursement is secondary to any protections your financial institution may have for stolen funds, meaning it’s unlikely you will actually receive any reimbursement from LifeLock in the event of a loss.

LifeLock Identity Theft Protection - Likes & Dislikes

What we like :

- Identity & credit monitoring

- Unique services, such as dark web monitoring, difficult to do on your own

- Bank account takeover & Credit card activity alerts.

- Easy to use dashboard

- A- Better Business Bureau rating

- valuable Up to $1,000,000 ID Theft insurance

- up to $1 million in fees for lawyers and experts.

- Offers court record monitoring and alerts if there are crimes committed in your name

- Family plans include a VPN

- Remediation available

- Discounts for paying annually

What we don't like :

- Expensive, especially compared with other options

- Many consumer complaints for untruthful advertising

- Most valuable features, such as monitoring of all three credit bureaus, only available at the highest price point

- FICO Scores are not available.

Frequently Asked Questions

What Is Identity Theft?

Identity theft is a crime where a thief steals your personal information, including your Social Security number, birthdate, or other personal details, with the aim to commit fraud. This fraud can include opening new credit card accounts in your name, applying for loans, and using your name to commit a crime.

What Can I Do If LifeLock Tells Me My Information Has Been Stolen?

You have a variety of options if you’ve been the victim of identity theft. Some of those options include:

- Filing a police report

- Freezing your credit, meaning no one can open new accounts

- Set up a credit monitoring account

- Changing the passwords to all your online accounts, especially financial ones, so they’re strong and unique

- Contacting the three credit reporting bureaus and putting a fraud alert on your account

What Types of Identity Theft Monitoring Does LifeLock Offer?

LifeLock monitors a variety of sources to see if you’ve been the victim of identity theft. Their services include:

- Credit report monitoring

- Dark web surveillance

- Lost wallet protection

- USPS address change verification

- Financial account activity alerts

- Reimbursement for stolen funds

- Alerts for crimes committed in your name

- Data breach notifications

- Court records scanning

Does LifeLock Protect My Identity from Theft?

No. LifeLock only monitors for unauthorized uses of your personal information, alerting you when this happens and allowing you to take action.

What is the identity theft insurance limit?

up to $1,000,000

Does LifeLock Offer Other Kinds of Services?

LifeLock only offers identity theft protection services, but it is partnered with Norton, which offers antivirus software.

How Much Does LifeLock Cost?

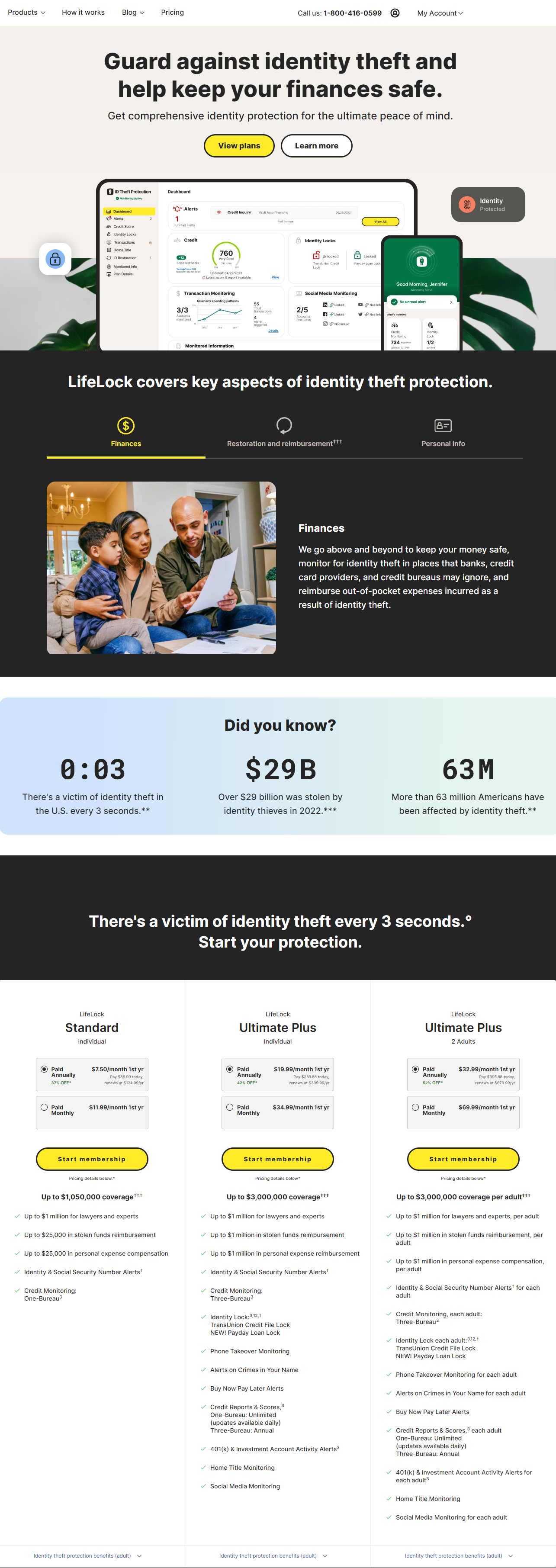

The cost for LifeLock depends on which plan you select, as well as whether you decide to pay monthly or annually.

LifeLock offers three tiers of monitoring: Standard, Advantage, and Ultimate Plus. Plans range from $98.90 to $296.90 per person, per year. An 8 percent discount is given for those who choose to pay annually. Child plans are available as well.

The relatively high cost of LifeLock makes it suited more to covering individuals instead of families, as the costs do add up with every person added to monitor.

Discounts on LifeLock Identity Theft Protection

LifeLock offers an 8 percent discount for customers who choose to pay annually instead of monthly. Additionally, LifeLock frequently runs specials on their services, allowing customers to save up to 30 percent off the advertised monthly fees.

How Does LifeLock Identity Theft Protection Work?

When you sign up for LifeLock, you give them access to your personal information. This includes your Social Security number, credit card accounts, and bank accounts.

They use this information to monitor your accounts – they check 1 trillion data points daily – for signs that someone may have stolen your identity or gained access to your financial accounts without your permission. The types of data they check and which of your accounts LifeLock monitors depends on the plan you choose, with the higher-tiered plan offering more comprehensive monitoring.

If LifeLock detects unusual activity on your account, they alert you to this activity. You then can take steps to help protect your information, such as freezing your credit card accounts, and a LifeLock representative can guide you through the process.

Sometimes, funds are stolen from your accounts as part of identity theft. LifeLock can reimburse you for up to $1 million of loss, depending on your plan, so you’re not out a large sum of money as well as being the victim of fraud.

LifeLock customers choose a monthly plan for protection, and you can receive a discount if you elect to pay for an entire year of monitoring up front.