Introduction

TransUnion is one of the three major credit bureaus in the United States. The other two being Experian and Equifax. TransUnion tracks the credit history of American consumers and generates credit scores and reports from that data.

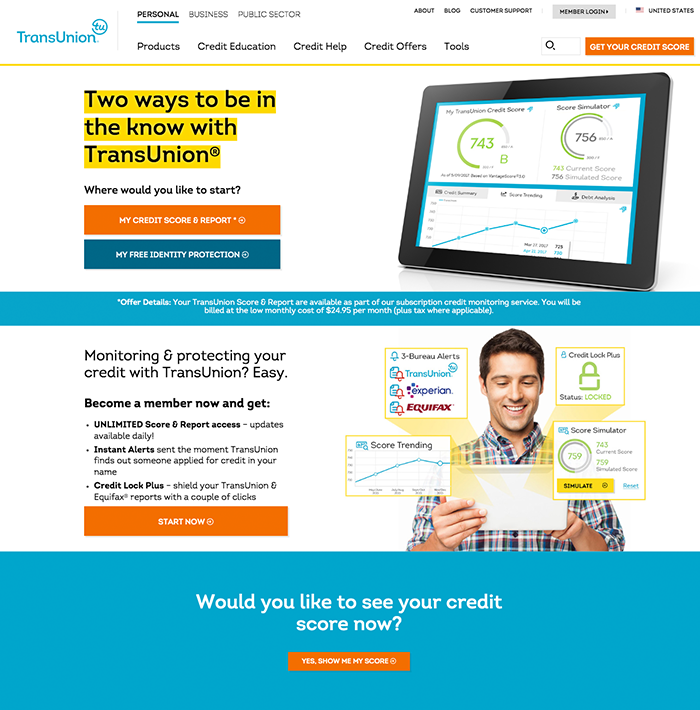

TransUnion is well known as one of the three major credit bureaus in the United States, but did you know that it also offers credit and identity monitoring? TransUnion’s services provide a combination of industry-standard and unique ways to monitor customers’ credit and protect their information.

Features

Credit Monitoring

Unlock powerful credit insights and safeguard your identity with TransUnion Credit Monitoring. Stay informed with real-time notifications about significant changes in your three-bureau reports. Access your complimentary VantageScore® 3.0 credit score and explore your TransUnion credit file. Our comprehensive identity protection features empower you to secure your TransUnion and Equifax credit reports, with up to $1 million in identity theft coverage. Receive instant email alerts for credit report inquiries and enjoy unlimited access to identity theft experts. Elevate your financial well-being with TransUnion Credit Monitoring.

Credit Monitoring

Unlock powerful credit insights and safeguard your identity with TransUnion Credit Monitoring. Stay informed with real-time notifications about significant changes in your three-bureau reports. Access your complimentary VantageScore® 3.0 credit score and explore your TransUnion credit file. Our comprehensive identity protection features empower you to secure your TransUnion and Equifax credit reports, with up to $1 million in identity theft coverage. Receive instant email alerts for credit report inquiries and enjoy unlimited access to identity theft experts. Elevate your financial well-being with TransUnion Credit Monitoring.

TransUnion Credit Monitoring - Pros & Cons

What sets TransUnion apart:

- Lock and Unlock your TransUnion and Equifax Credit Reports

- Instant email alerts sent as soon as TransUnion finds out someone’s applied for credit in your name.

- A- rating from the Better Business Bureau (BBB).

- Unlimited updates to your TransUnion Credit Report and Score.

- Up to $1,000,000 ID Theft insurance

- Unlimited toll-free access to ID theft specialists

- Score Simulator—see how specific credit choices may affect scores

- Email updates of critical changes

- Personalized debt analysis and credit score trends.

Where TransUnion falls short:

- The scores given varies from your FICO® score, which is what lenders generally use.

- Does not provide access to all three credit bureau reports.

- No free trial available.

- No free credit monitoring.

- FICO Scores are not available.

Frequently Asked Questions

How much is TransUnion Credit Monitoring?

TransUnion Credit Monitoring charges a monthly fee of of $29.95 + tax where applicable.

How long is TransUnion's trial period?

No, TransUnion Credit Monitoring does not offer a free trial.

How accurate is TransUnion Credit Monitoring?

TransUnion Credit Monitoring is as accurate as the information on your credit bureau reports. Only you can tell if the information is incorrect or incomplete. Your credit reports can differ significantly depending on which credit bureau’s data you use. So, it is a good practice to check all three credit reports.

Does TransUnion Credit Monitoring offer identity protection?

TransUnion Credit Monitoring offers the following identity protection service.

- Identity Theft Insurance

- Identity Theft Monitoring

- Identity Restoration Support

What is the identity theft insurance limit?

TransUnion offers coverage for identity theft up to $1,000,000

How to contact TransUnion Credit Monitoring?

The easiest way to contact TransUnion Credit Monitoring is visit their website and go to their help and support page. You can typically find a link on the footer of their homepage. If you’re interested in opening an account.

How to cancel subscription?

To cancel your TransUnion subscription, log in as you usually do. Go to your profile or account page and request a membership cancellation.

Does TransUnion help with fixing credit report errors?

Yes, TransUnion Credit Monitoring helps dispute incorrect or incomplete items on their credit reports.

Does TransUnion share my information with other credit reporting companies?

No. TransUnion does not share any credit information. If you are looking to obtain your Experian or Equifax credit report, you must contact them directly.

Important Note :

The credit scores provided are based on the VantageScore® 3.0 model. Lenders use a variety of credit scores and are likely to use a credit score different from VantageScore® 3.0 to assess your creditworthiness.

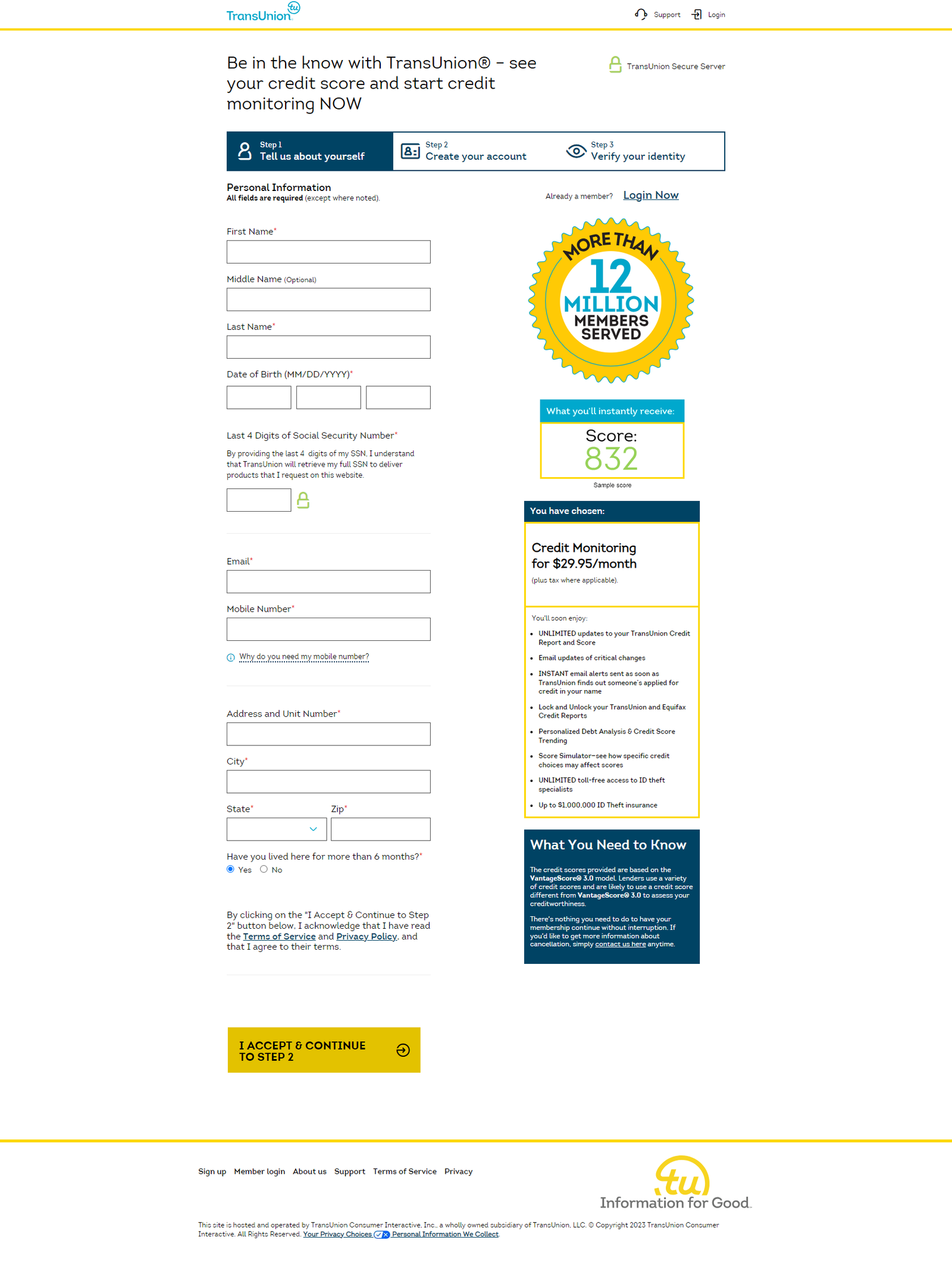

How to sign up for TransUnion Credit monitoring Services?

Signing up for a TransUnion account online is simple. You must provide personal information and verification information to establish your identity. A TransUnion Consumer Disclosure is accessible for free on the website, which provides basic information. However, credit details and reports that include your current credit score must be purchased.